Mary Buffett, David Clark

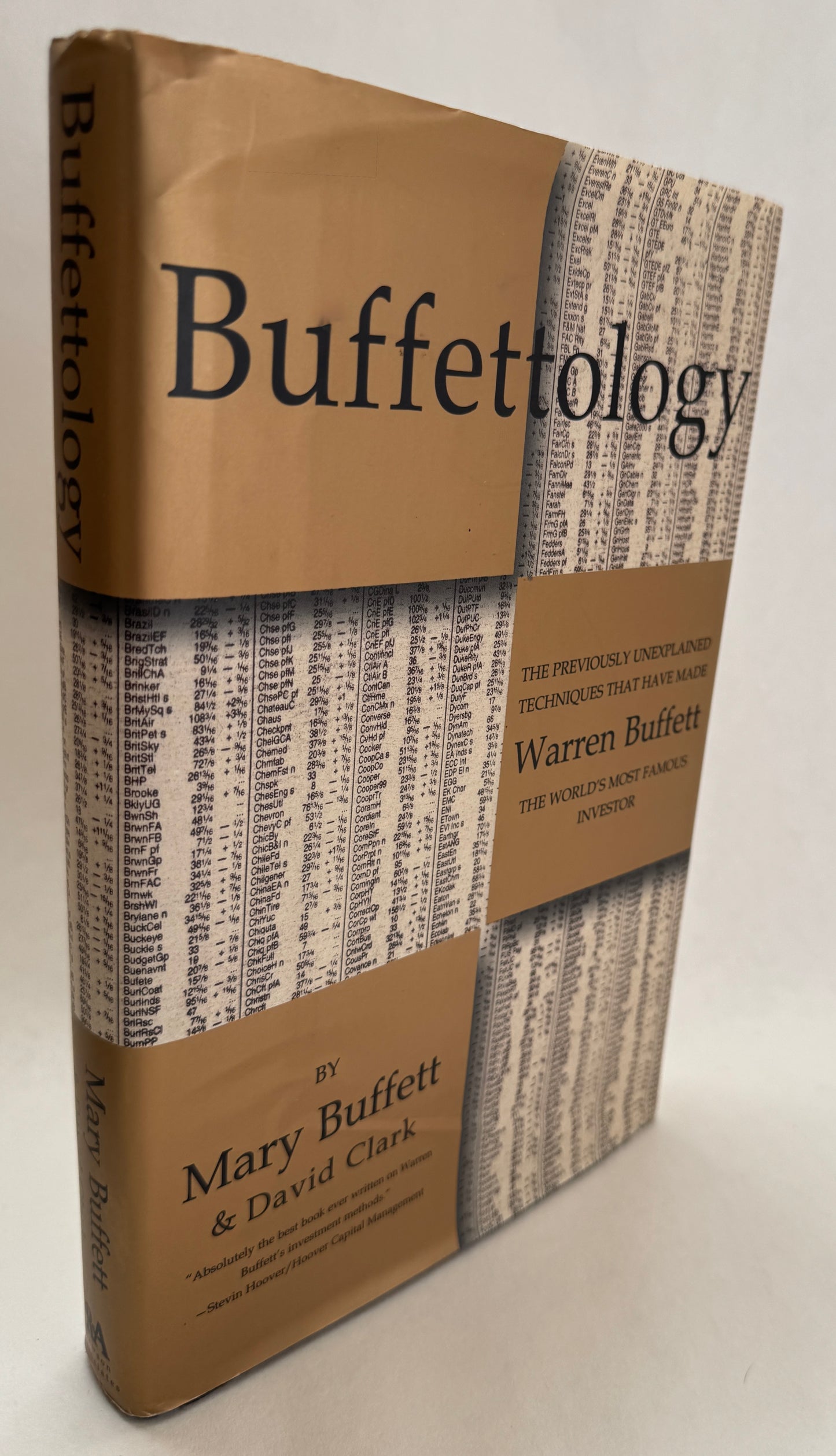

Buffettology: the Previously Unexplained Techniques That Have Made Warren Buffett the World's Most Famous Investor

Buffettology: the Previously Unexplained Techniques That Have Made Warren Buffett the World's Most Famous Investor

Couldn't load pickup availability

New York: Rawson Associates, 1997. First ed., first printing (full number line). Quarto in duo-tone gold pictorial jacket; 320 pages; 25 cm Fine in near fine jacket, with a few minor crinkles; now in archival myalr. Small neat gift inscription to front free endpaper. . Hardcover. ISBN: 9780684837130, 0684837137

The authors explain "what kinds of companies Buffett looks for and why, and which he avoids and why ... the mathematical models and equations Buffett uses to determine the basic value and earnings potential of his final choices," his arbitrage options, and a comprehensive list and brief analysis of 54 companies in which he has invested.--Jacket // Table of Contents: PART I: THE ART OF BASIC BUFFETTOLOGY1. Before You Begin This Book2. How to Use This Book3. Roots4. Investing from a Business Perspective5. What Is Businesslike Investing?6. Warren's View of Earnings7. The Price You Pay Determines Your Rate of Return8. The Corporation, Stocks, Bonds -- a Few Useful Explanations9. Valuing a Business10. The Only Two Things You Need to Know About Business Perspective Investing: What to Buy -- and at What Price11. What We Can Learn from Warren's Secret Weapon: The Magic of Compounding12. Determining What Kind of Business You Want to Own13. The Theory of an Expanding Intrinsic Value14. The Mediocre Business15. How to Identify the Excellent Business -- the Key to Warren's Good Fortune16. Nine Questions to Help You Determine If a Business Is Truly an Excellent One17. Where to Look for Excellent Businesses18. More Ways to Find a Company You Want to Invest In19. What You Need to Know About the Management of the Company You May Invest In20. When a Downturn in a Company Can Be an Investment Opportunity21. How Market Mechanics Whipsaw Stock Prices to Create Buying Opportunities22. Inflation23. Inflation and the Consumer Monopoly24. A Few Words on Taxation25. The Effects of Inflation and Taxation on the Rate of Return, and the Necessity to Obtain a 15% Return on Your Investment26. The Myth of Diversifications Versus the Concentrated Portfolio27. When Should You Sell Your Investments?28. Warren's Different Kinds of InvestmentsPART II: ADVANCED BUFFETTOLOGY29. The Analyst's Role in Ascertaining Earning Power30. The Mathematical Tools31. Test #1, to Determine at a Glance the Predictability of Earnings32. Test #2, to Determine Your Initial Rate of Return33. Test #3, to Determine the Per Share Growth Rate34. Determining the Value of a Company Relative to Government Bonds35. Understanding Warren's Preference for Companies with High Rates of Return on Equity36. Determining the Projected Annual Compounding Rate of Return, Part I37. Determining the Projected Annual Compounding Rate of Return, Part II38. The Equity/Bond with an Expanding Coupon39. Using the Per Share Earnings Annual Growth Rate to Project a Stock's Future Value40. How a Company Can Increase Its Shareholders' Fortunes by Buying Back the Company's Stock41. How to Determine If Per Share Earnings Are Increasing Because of Share Repurchases42. How to Measure Management's Ability to Utilize Retained Earnings43. Short-Term Arbitrage Commitments44. Bringing It All Together: The Case Studies:Gannett Corporation, 1994Federal Home Loan Mortgage Corporation, 1992McDonald's Corporation, 1996How Warren Got Started: The Investment Vehicle46. Fifty-four Companies to Look At47. Waiting for the Perfect Pitch EpilogueIndex

Share